According to reports from the UIV Observatory, in export 2022 there has been the overtaking of premium wines over popular ones. For President Lamberto Frescobaldi, “the leverage for growth is increasingly based on the concept of luxury and Italianness, rather than tradition.”

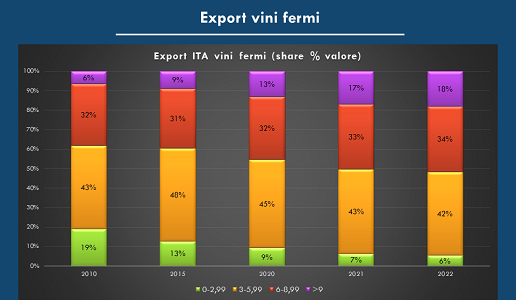

The world trade in still wines is marking time, with volume declines in the last year of around 5 percent, but the premium trend in consumption is increasing, starting with Italian reds. According to the Uiv Observatory’s analysis of market trends over the past 12 years, made-in-Italy wine has in fact seen a fourfold increase in volume sales of still wines in the super-premium range (over 9 euros per bottle ex cellar) over the period, with an average annual growth of 13 percent. The picture is even more significant when looking at value: from a niche with a 6 percent share of total exports in 2010 to an increasingly decisive asset in 2022, with the market share of super-premium wines coming to be worth 18 percent, or 863 million euros. At the expense, particularly the entry-level segment, which over the same period marks a decline in share from 19 percent to 6 percent.

“We are witnessing,” said the president of Unione italiana vini (Uiv), Lamberto Frescobaldi, “a positive evolution in the positioning of our product, in line with what is happening with other sectors of made in Italy. Luxury Italy wins in the world,” he added, “for example, with the Italian fashion system, Ferrari, design, agribusiness. And, last but not least, the world of wine has refined its international appeal even beyond the traditionally known territories, because today it is Italian-ness, more than tradition, that wins in the markets.”

According to the UIV analysis, for the first time in history last year exports of premium and super-premium still products (from 6 euros and up) surpassed those in the entry-level and popular range. Indeed, in 2022, the former occupy a 52 percent market share (at 2.5 billion euros), compared with 48 percent for lower-value products. A long race toward premiumization started quietly and then recorded double-digit incremental averages year after year, with the surge in the post-Covid period. Different, according to the Observatory, is the discourse on sparkling wines, where the dominance of Prosecco in the popular segment-a school case on a global scale that has retraced the approach to extra-meal consumption even among young people-has left little room for the premium segments.