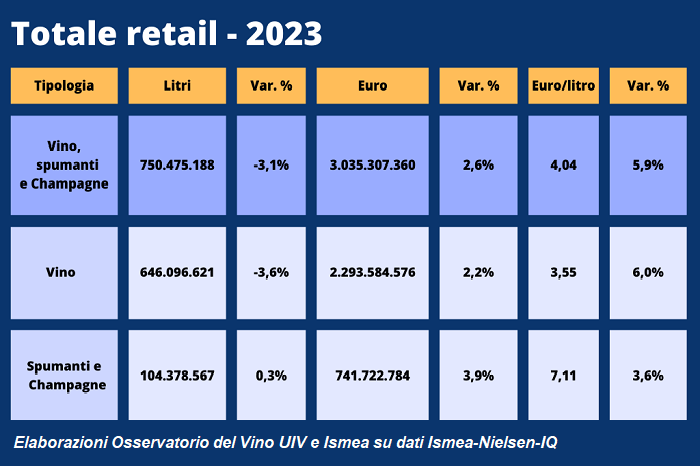

According to the Uiv-Ismea Observatory in 2023volumes of wine in the large-scale retail trade dropped by 3.1 percent, to 3 billion euros. Trends in the medium term: consumption down 8% from 2019, but PDO wines hold up. Common wines and reds nosedive, sparkling wines go up again.

They return by a little under 1 billion bottles of wine sold in Italian stores and supermarkets in 2023, 3.1 percent less than the previous year for a total value of Just over 3 billion euros. This is noted by the Uiv-ISMEA Observatory based on Ismea-Nielsen-IQ in relation to sales of wine in large-scale retail and mass merchandisers through 2023.

A complicated year, according to the Observatory, which, while amplifying new post-Covid consumer trends, resulted in more than one hardship for a sector grappling with generalized price increases that have not yet been absorbed and well beyond the timid growth recorded in value (+2.6 percent). Still wines set volumes at -3.6 percent (with reds at -4.9 percent) and recorded the 11th consecutive quarter with a minus sign. Sparkling wines, even with a zeroing of price growth in the last quarter, remain on a buoyant line compared to the volumes sold in the previous year, but only thanks to the “low cost” Charmat non Prosecco (+7.1%), without which the type would turn negative by 2 points.

In general,” highlights the Uiv-ISMEA Observatory, “the evolution of wine consumption by Italians from 2019 to the present has been significant and reflects factors only partly mirrored by the economic situation. Often, in fact, such sharp and only seemingly sudden changes are dictated by structural changes in demand that have never been so fluid in terms of beverage consumption. Among them:

Consumption down, but more selective

Compared to 5 years ago, and after the surges of the Covid years, among the shelves the drop in consumption is close to 8%, the equivalent of 100 million bottles largely based on still wines (-11%) and fortified wines (-19%). PDOs, at -2%, are by far the category that yields the least, with whites (+3%) and rosés (+17%) marking green light. Doing much worse are IGTs (-13%) but especially common wines, nosediving to -17% and the equivalent of 64 million fewer bottles.

Sparkling wine trend

On the one hand, still wines are down 11 points; on the other, sparkling wines gain almost 19 percent in a five-year period, now at 139 million bottles sold. Credit to the Prosecco world, which is up 30 percent over the period, but also to non-Prosecco Charmats, up 42 percent thanks to a meteoric rise particularly in the last two years in which lower purchasing power also played a role. A trend, that of Italian bubbly, that has long been reflected in exports as well, withthe type seeing its market share triple in the past 10 years. The same cannot be said for champagne, whose sales in the period fell by 38 percent.

SOS Reds

Premised on the fact that the high-end reds are by far more present at the horeca channels, where certain appellations or products have become timeless, it is undeniable that – in general – the symbolic type of tricolor wine is the most struggling in household consumption with a descent, steadily steepening in recent years, of 15 percent. Reds give up 6 percent-almost 3 times more than average-among consumption of appellation products, 19 percent among IGTs, but the record (negative) is among ordinary wines, with -22 percent. Few of the big DOPs and IGTs are holding up (Montepulciano d’Abruzzo Dop at -2%, Chianti at -3, Rubicone Igt in the Sangiovese type at +7%), many double-digit declines, and often over 20% for branded wines such as the Lambrusco family, the Apulian (Salento Igt, Puglia Igt), the Sicilians with Nero d’Avola Dop and Terre Siciliane Igt), Sardinia’s Cannonau, the Piedmontese (Barbera and Dolcetto Doc), the Veneto (Igt Cabernet and Merlot), the Lombards, with the Oltrepò Pavese Barbera and Bonarda Doc

E-commerce on the roller coaster

Lockdowns have helped boost e-commerce orders, a historically hostile channel for Italians. Today, online purchases are worth three times as much as in 2019, but for the past 2 years, orders have gradually deflated, to the point of losing 21% over the 2021 peak. A physiological decline for a roller coaster channel that also implemented a significant decline in listings. Those who order online do so by researching even more the quality – the average price per liter is 61% higher than in lane purchases -, buys more PDOs and IGTs (75% of total purchases of still wines) but most importantly orders more sparkling wines, which online account for 22 percent of purchases, compared to an overall average at 13 percent. A niche-that of wine e-commerce-which accounts for just 1.5 percent of total GDO and retail purchases, which many players are relying on for the future.