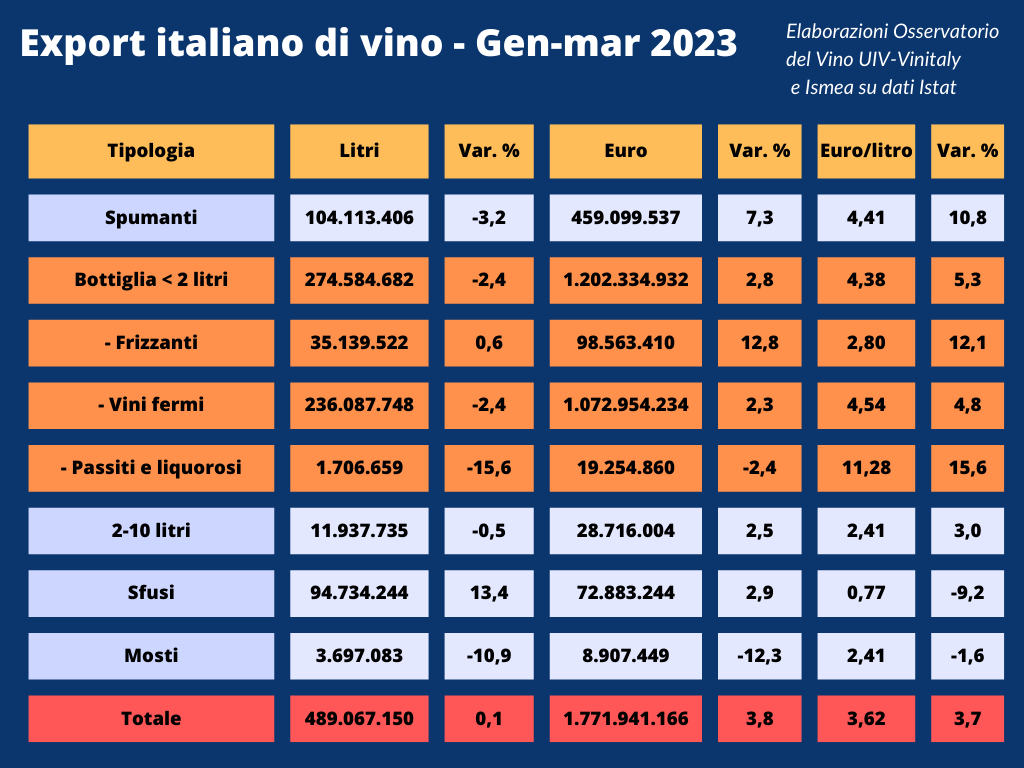

According to data compiled by the Uiv-Ismea-Vinitaly Observatory, in the January-March 2023 period, Italian wine exports recorded flat volumes and a barely positive value (+3.8%9 when compared to the growth in spending. Still down red wines, in contraction PDO and PGI, better low cost wines, communes and bulk.

A complicated first quarter closes for Italian wine sales abroad, with volumes flat (+0.1%) and a trend performance in value at +3.8% (€1.8 billion). This was noted by the Uiv-Ismea-Vinitaly Observatory, which processed the latest Istat data on foreign trade. Marketed volumes, the Observatory points out, are kept afloat by the exploit of bulk wine sales (+13.4 percent) – which, however, record a sharp drop in list prices (-9.2 percent) – and communes, at +12.8 percent.

Suffering, again in volumes, were the flagship products of Made in Italy, starting with bottled PDO still wines, which fell -5.3% (+2.5% value) with reds at -6.6%. Igp wines are also down (-2.5%), where the growth of whites (+8.3%) was not enough to calm the loss of reds (-7.5%) and where the red sign is also evident in values. Among the types, the difficult start for sparkling wines (-3.2% volume and +7.3% value) is confirmed, due to the contraction of exported volumes of Prosecco (-5.5%), while the good season of Asti Spumante (+9.1%) and common sparklings (+4.4%) continues.

“In this first quarter,” said the secretary general of Unione italiana vini (Uiv), Paolo Castelletti, “the too-short blanket is increasingly evident: growth in value is in fact insufficient to cope with the cost surplus dictated by raw materials and energy, which affects about 12% on an average price increased by just 3.7%. The considerable difficulties of reds, especially PDO and PGI, remain, compounded by the setback for sparkling wine. More generally, the current economic situation is forcing demand to make low-cost choices, which is why in volume terms basic products that have adjusted prices little do better. But at what price?”

“The world wine market is sending signs of change that seem to favor lower-end wines at the moment,” commented Fabio Del Bravo, head of Ismea’s Rural Development Services Directorate. “Looking at the export dynamics of our main competitors, France appears to be particularly penalized by the current market orientation, and is registering a 7.5 percent reduction in quantity flows (+3.4 percent receipts). Spanish wines, on the contrary, are favored by a more competitive price and sprout progressions in both volume (+3.8%) and value (+11.4%). As for our exports, we are far from the growth rates to which sector had accustomed us in recent years. Also complicating the picture is the evident slowdown in sales to distribution on the domestic market and the nearly 53 million hectoliters of wine stored in factories, which, although down on the record values of the past few months, show growth of more than 4 percent over last year.”

On the market front, the EU marketplace grows in volume (+7.3%) and the non-EU marketplace shrinks (-7.7%); among the top buyers, the U.S. remains in positive territory (+0.4% volume, +10.8% value) Germany grows (+6.2% in volume and +5.6 in value) thanks to bulk, while the U.K. gives up 13.5% (-7% value). In contraction, in volumes, outlet and emerging markets such as Canada (-24%), Switzerland (-8.4%), Japan (-22.9%) and the Chinese market is confirmed to be in free fall (-43.7%). Orders from Russia are flying: +33.0%.

Among regions, export values slow down for the top 3, with Veneto at +3%, Piedmont at +0.2% and Tuscany at +0.6%. Above average increases for important producing regions, such as Trentino-Alto Adige, Emilia-Romagna, and Lombardy.